07 | It’s bitcoin’s world. We’re living in it.

Hey all, thanks for subscribing. I’m back with Two Cents, after a hiatus late last year. I hope everyone had a safe and happy new year! 2021 is a banger already. This year I’ll be focusing on questions related to crypto products, adoption, and design. I’ll also be providing a few project updates through this newsletter. As always, would love to hear from you on how I can make this newsletter better or say hi!

Bitcoin’s existence and future success, have become heavily derisked. In the U.S., ~90% of adults are aware of bitcoin, with growing conviction. As an investment - bitcoin generated the greatest returns of the past decade. But what I love about bitcoin, is that it keeps proving the world wrong. It’s multi-faceted, meaning something different to everyone, and has generated one of the most intellectually stimulating debates of the decade.

What does bitcoin ownership say about its history?

This question has a lot to unpack. Bitcoin is widely regarded today as an aspirational store of value, a gold 2.0. But it’s taken a decade of narratives to get to even this point. As a user-owned network - the people who hold or use bitcoin also participate in the value created. For some, bitcoin is simply a speculative bet. For others, it’s a way to opt-out of the traditional financial system or send value anyware. It’s a censorship-resistant technology. It’s more personal than simply an investment to some. Although it might seem obvious to those in the crypto industry, it's worth exploring at a high level how someone comes across bitcoin. Who owns it? What are the entry points for bitcoin today compared to a decade ago?

The first question has a few data points. Studies like the Cambridge Cryptoasset Benchmarking Report, suggest there are over 100M users of bitcoin. This likely represents the lower bound of users around the world. Bitcoin was a retail phenomenon early on. The first 5+ years of bitcoin was primarily driven by individual investors rather than larger institutions. But things are different now. The recent bitcoin rise points to a much more institutional investor base (e.g., hedge funds, family offices, public companies). We know, for example, Microstrategy, Square, and a few public hedge fund positions account for millions of 2020 bitcoin purchases.

What are the entry points for bitcoin adoption?

The market is quite diverse today. First we have crypto-native products & solutions, initially built to solve a market problem. Next we have products that aim to onboard users easily, such as earning bitcoin. Lastly, we have existing fintech brands integrating bitcoin services. I’ll describe each briefly - as well as how each addresses a different demographic.

Crypto native - this category deserves its own in-depth breakdown but I’ll keep it brief. Since the early days, crypto builders took to themselves to develop exchanges, wallets, custody to natively support these assets. Nothing else existed. This is where the cypherpunks, libertarians and early crypto enthusiasts quite literally built the infrastructure. Today, the most popular U.S. exchange is Coinbase, which services 43M retail users and hundreds of institutional clients. For those who do not want to use a 3rd party custodian like Coinbase, there are dozens of self-custody wallets available. The majority of new retail users are likely to find their way to a Coinbase, Gemini, etc. unless they have done serious homework.

Earn / Use It - This category encompasses those trying to seamlessly onramp new users to crypto. This includes earning bitcoin through browser extensions like Lolli or earning cash-back rewards on debit cards / credit cards like Fold or BlockFi. This adoption funnel is primarily retail-focused, where users get exposure to bitcoin without requiring a major shift in their behaviors.

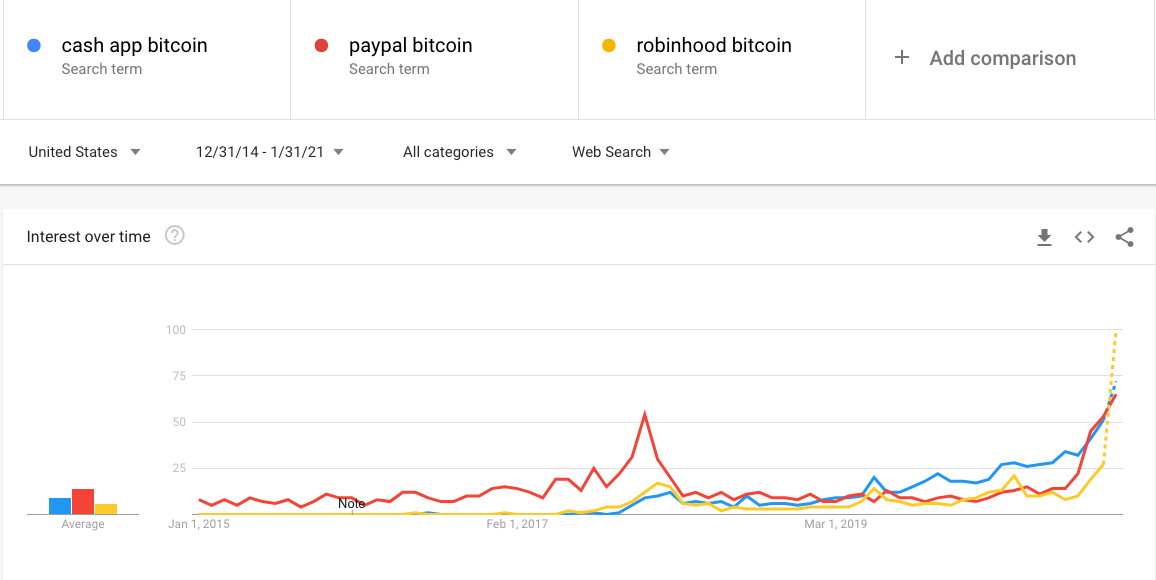

Fintech meets bitcoin - Lastly, we have the availability of bitcoin on popular fintech platforms. This includes Robinhood, Square and most recently, PayPal. These services onboard users that are (1) crypto curious but not willing to go open a new account (2) offer differing demographics. PayPal has 300M+ users globally, while Square and Robinhood are more millennial / gen-z US-based. With the most recent bitcoin price surge, we saw a rise in interest for these products.

What are alternative ways to get exposure to bitcoin?

Grayscale’s GBTC bitcoin trust has been an institutional favorite despite them charging a premium on the price of bitcoin. Grayscale has $20B in AUM, doubling from $10B in the past few months. In the public markets, ARK Invest’s ETF offers exposure to bitcoin, as well as buying public company stock where they hold bitcoin as a part of their reserves (e.g., Microstrategy and Square). A potential ETF approval in the next 24 months, which would represent a major adoption funnel for retail investors.

What am I missing? How many people will get their hands on bitcoin and how do we ensure this is a distributed, decentralized technology in the hands of many. What will the next 100 million look like?

A few ideas:

While bitcoin is available to everyone - the next immediate phase of bitcoin adoption will largely be seen by sophisticated investors and institutional appetite. This is largely why I think consumer-facing products are incredibly important to continue to build diverse and accessible onramps.

Emerging market adoption of bitcoin has been slowly building, but I think will see an explosion in the next decade.

The financialization of bitcoin will extend the ways investors get access

Governments will begin quietly accumulating bitcoin, this may already be the case

Owning bitcoin will become part of the “model portfolio”

Until next time! If you enjoyed this post, please feel free to share it!